Brian McArthur of Bridlewood Insurance on the Obstacles to Digital Innovation in Financial Services

In this installment of our series Perspectives in Financial Services, we sit down with Brian McArthur of Bridlewood Insurance to discuss the obstacles that keep established financial advisories from updating their web design.

Brian McArthur is Vice President of Sales for Bridlewood Insurance and creator of the Medicare Execution Process; he works side-by-side with financial advisors to help them understand Medicare and integrate its requirements into their advisory processes. Working with advisors to navigate the complex landscape of post-retirement healthcare coverage, McArthur sees a wide gamut of responses to digital innovation.

In a previous interview, Lisa Tanen-La Fontaine of LL Global and LIMRA shared with us the impact smart UX can have on client retention and satisfaction. This week, Brian McArthur discusses the unexpected barriers preventing legacy financial services companies and long-time financial advisors from updating their web design.

Why FinServ Companies Aren’t Rushing to Fix Their UX

As anyone who’s ever tried to roll over their 401(k) or find a financial advisor online likely knows, financial services companies are not leading the way in attractive, compelling UX design. But as McArthur points out, the prevalence of lackluster web design in the financial services sector is rarely a result of inertia or resistance to innovation.

Financial services is a heavily regulated industry, and designing websites for advisors comes with unique compliance requirements relating to security, consumer protections, and ADA accessibility. According to McArthur, these requirements are why advisors hesitate to seek out creative, engaging marketing and innovative UX design. It’s not the complexities of compliance requirements themselves, but rather the impact of regulation on the industry’s overall attitude toward change.

“If you have a creative idea and come in and tell me about it, the answer is more likely than not ‘no,’” McArthur says. “That kind of attitude isn’t unique to any one firm. That’s created an environment where ideas that you and I might consider creative, helpful marketing just doesn’t get through.” Wary of costly compliance violations, industry leaders often adopt a “better safe than sorry” approach to UX design and opt for the “tried and true” rather than seek out new digital innovations.

Because their peers are slow to innovate, legacy financial services institutions generally do not feel the pressure to change. As long as their competitors are sticking with outdated UX and simple marketing, they’re free to do the same.

“If one of these big entities has a clunky method to roll over 401k assets into an IRA, it’s probably because they only have a handful of competitors,” McArthur explains. “And if those competitors aren’t improving their processes, there’s no incentive to do so.”

Digital Disruption Is a Game-Changer

Four years ago, fintech startups made up 5 percent of the market for personal loans. Now, they comprise an impressive 45 percent. Notably, leading fintech companies are diversifying from their initial offerings. Robinhood has branched out from trading to cash management, and Square has added e-commerce transaction software to its signature lineup of point-of-sale hardware.

More importantly, digital is changing expectations about consumer loyalty. According to McArthur, financial advisors have historically relied on high retention rates. Clients in the past have stayed loyal — even when they are underserved — simply because it can be too much of a hassle to move assets from one firm to another.

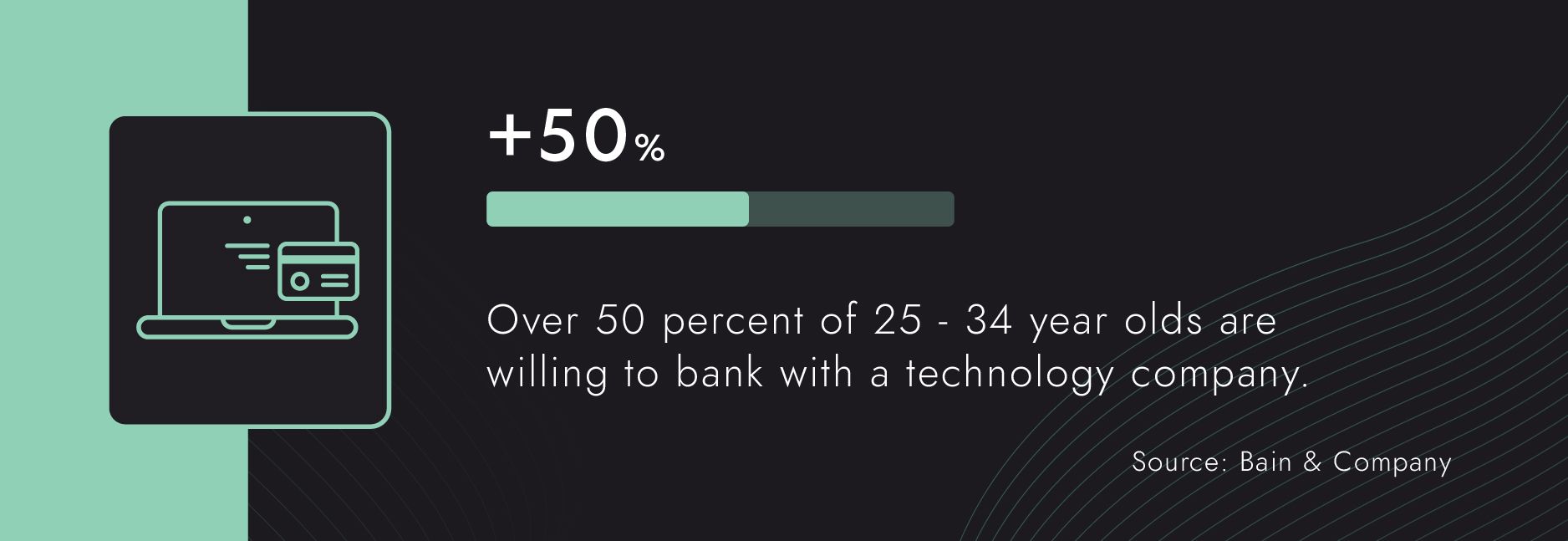

But consumers in the financial services sector in general are becoming less loyal. According to a Bain & Company consumer survey, over 50 percent of younger respondents were willing to bank with technology company. As the demographic continues to shift in the coming years, web design will become more a crucial part of client retention in the very near future.

Technical Compliance Can Drive UX Innovation

Driving UX innovation in finserv relies on striking a balance between “the way things have been done” and “the way things should be done.” Fortunately, although compliance challenges can seem daunting, they also drive innovative design. The same elements that demonstrate compliance can also boost the credibility of your website and help you attract new clients.

Achieving technical compliance in areas such as ADA accessibility requires introducing user-friendly color contrast and sequence of information — the same elements that improve user experience and ensure that your financial institution also appears professional and trustworthy. In a changing industry, it’s never been more necessary to keep apace with evolving customer expectations — embracing technical compliance is a key part of communicating credibility as an institution.

Related Insights

We’re looking forward to working with you, too.

Start conquering the digital terrain today.